每日一言

Success is determined by those whom prove the impossible, possible

——成功取决于那些能够证明不可能、可能的事情的人

1:有没有可以使用几十年的电池?

☢️🔋 核电池利用放射性衰变可以持续供电数十年。

科学家自20世纪初起就希望利用放射性原子制造出超长寿命且耐用的电池,但早期的原型效率较低。

最近,中国科学家成功将一种核电池的效率提高了8000倍。

研究人员使用了通常被视为核废料的镅(Americium),它通过释放α粒子来辐射能量。科学家将镅嵌入到聚合物晶体中,将其能量转化为持续稳定的绿色光芒。

虽然镅的半衰期长达7380年,但由于电池周围的材料会受到辐射损坏,这种微型核电池的寿命预计为几十年。

该电池适合用于深海探测和太空任务,因为它不需要维护且寿命极长。

2:3D打印技术是什么时候发明的?

📌 1980年代是3D打印技术发展的关键时期。

1981年,日本发明家小玉秀男为3D打印奠定了基础。他发明了一种使用光敏树脂逐层构建三维物体的系统,这成为了增材制造的先驱。

1984年,美国发明家查尔斯·赫尔(Chuck Hull)申请了立体光刻(SLA)的专利,这是首个商业化的3D打印技术,引入了逐层制造的概念,这也是现代3D打印的基础。

早在实验室技术成熟之前,3D打印的概念就出现在科幻小说中:

1945年,在《Things Pass By》一书中,**默里·莱斯特(Murray Leinster)**设想了一种使用“磁性塑料”从图纸中制造物品的设备。

1950年,雷蒙德·F·琼斯(Raymond F. Jones)在《Tools of the Trade》中介绍了“分子喷雾”技术,用于逐层创建物品。

3:有哪些最大的3D打印物品?

🛳 世界上最大的3D打印船长度:11.980米实现者:阿布扎比海事局和Al Seer Marine(阿联酋)制造日期:2023年11月6日

⬛️ 按体积计算的最大3D打印结构体积:11.07立方米实现者:迪拜市政厅(阿联酋)制造日期:2019年10月16日

⚙️ 最大的金属功能3D打印部件部件:直径1.5米的涡轮风扇发动机组件制造者:劳斯莱斯制造日期:2014年7月

🏠 最大的3D打印别墅面积:303.43平方米实现者:3DXB集团、迪拜市政厅和穆罕默德·本·拉希德住房机构(阿联酋)制造日期:2023年12月7日

🏳️ 最大的3D打印旗帜面积:16.2688平方米实现者:Anmar Gabra(沙特阿拉伯)制造日期:2024年8月18日

4:有哪些最小的3D打印物品?

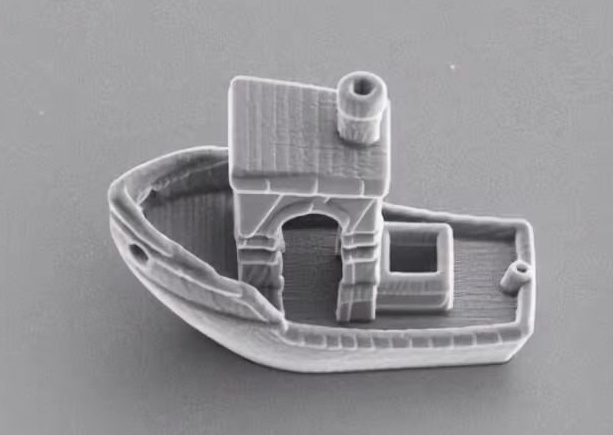

🛳 世界上最小的3D打印船

尺寸:11.5微米(0.0004英寸),约为人类头发直径的三分之一制造者:荷兰莱顿大学团队年份:2020年制造目的:用于研究微型游动器(microswimmers),即在液体中移动的微小颗粒。

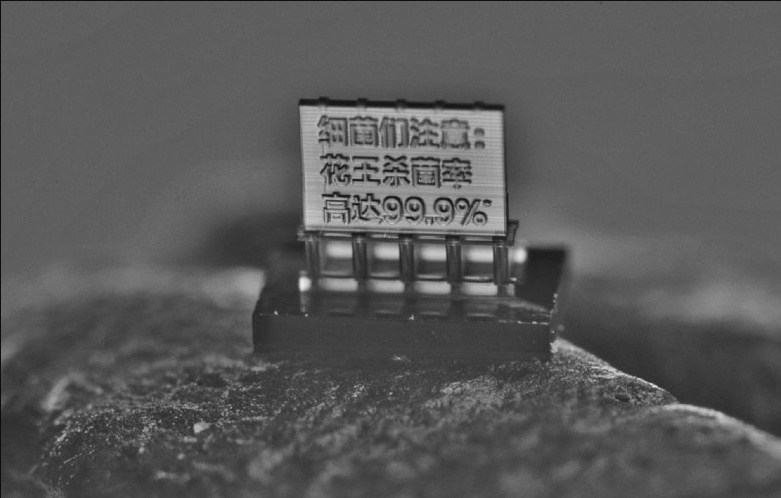

🪧 最小的3D打印广告牌

面积:1.424平方毫米(0.002平方英寸)制造者:Kao Commercial,上海,中国制造日期:2021年12月

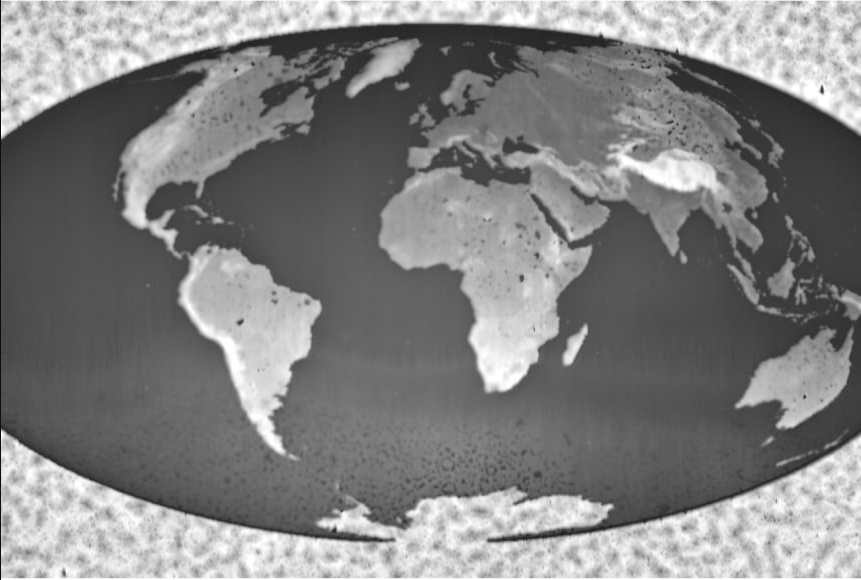

🗺 最小的3D地球地图

尺寸:每个大陆图案仅有15纳米的细节,1,000个这样的地图可以放在一粒盐上方法:使用超尖硅刀在聚合物基板上雕刻应用:超精密纳米制造技术。

往期:《每天知道亿点点》日刊

评论区